What’s the best time to trade an NFT in 2022? No one knows for sure but it’s safe to say that there are plenty of indicators that we can use to clue us in on the fate of any given project and help us make decisions on when to buy and sell the projects. Here are some strategies and concepts I use to not lose money on NFT.

Have you seen this picture NFT before, I’m sure you have this crypto punk #1422 someone bought it for $80 back in 2017 and now recently sold for $2 million dollars.

Insane, So naturally, like you and me, “you think you can do this too.”

However, like everything else, things aren’t as simple as they seem and trading NFTs can destroy your portfolio if you don’t keep certain things in mind.

So if you don’t want to lose money then follow these few tips:

1. Established NFT projects are safer bets

Even if you passively follow the NFT market, you will notice that the market comes with a lot of hype when it is released then go nowhere after that. Projects are getting better at rug pull aka scam your money or make you feel you are FOMO then don’t deliver what they are promise.

The only way to ensure you are not losing your money is to try to acquire “blue-chip” projects.

The blue-chip project like CryptoPunks, Cool Cats, Bored Ape Yacht Club, and VeeFriends. They are really solid but they are expensive. Look at Bored Ape Yacht Club the cheapest APE sell for $80,000 down like a downpayment for the 300,000 house.

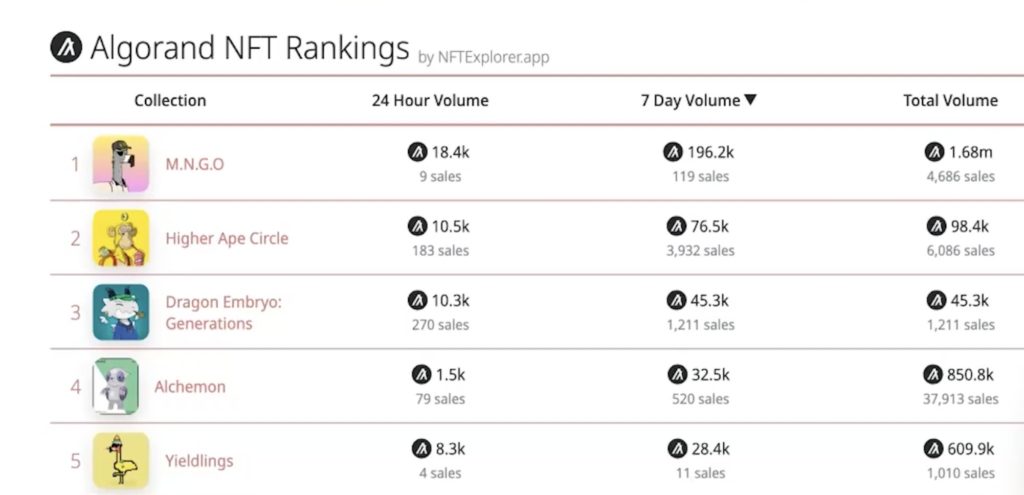

Now let’s take a look at another project, not the Ethereum NFT project but Algorand NFT project.

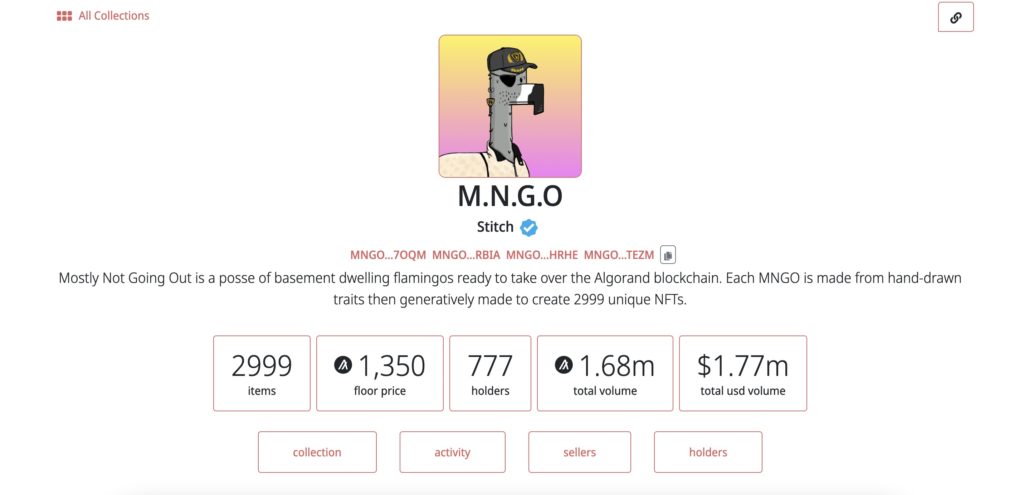

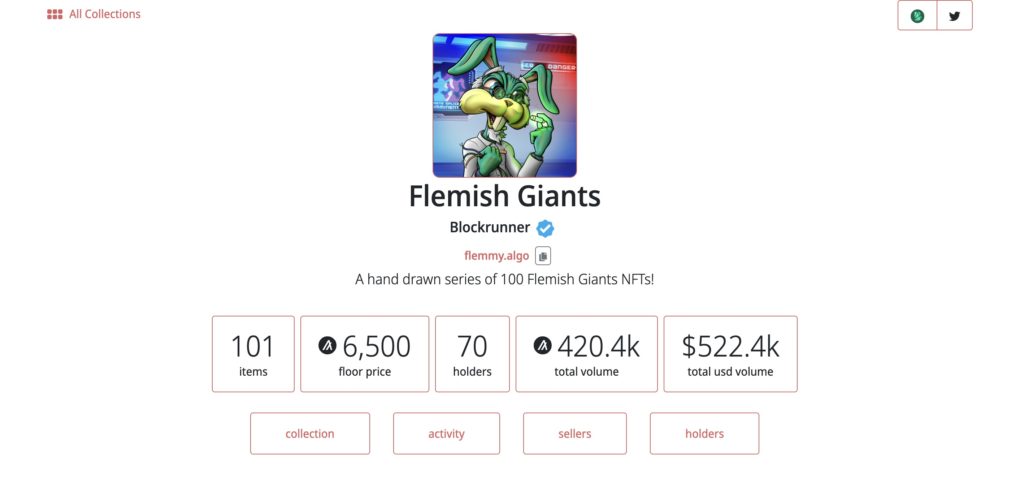

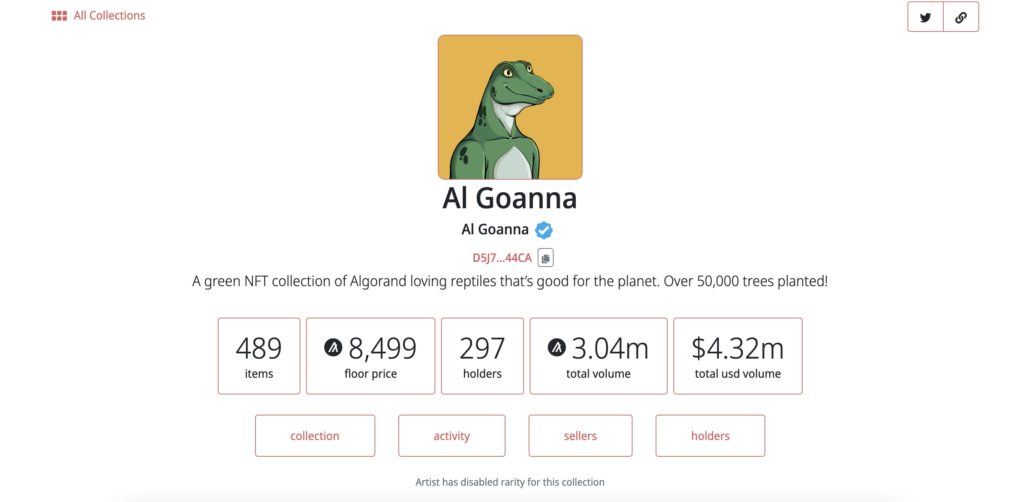

Three blue-chip NFT collections on Algorand, M.N.G.O, flemish clone, and Al Goanna.

MNGO cheapest price sells 1350 Algorand equivalent to $400.

Flemish Clone’s cheapest price sell for 6500 Algorand equivalents to $2000.

Al Goanna cheapest price sell for 8499 Algorand equivalents to $2700

People in crypto are too often looking for instant gratification with a quick 2–3X. It can pay off to have a portion of your portfolio dedicated to riskier bets.

But you should be trying to be a part of projects that have been under active development for a longer period of time. So hold it for a long term and you will receive your reward.

Here’s a small nugget for you a project that proves its staying power over a period of more than 6 months can be termed as “established” aka a “blue-chip”.

2. Be open to other upcoming blockchains

You don’t have to pay a fortune to purchase an established NFT project as I mentioned before. Ethereum and Solana have the NFT projects with the highest volume and floor prices.

But they are also the platforms where the competition is the toughest for newer collections and any normal people like you and me would be priced out from buying “blue-chip” NFTs.

Now look at layer one blockchains like Algorand and Cardano, which have survived a bear market already and will hopefully survive this one too. The upside of NFTs on smaller chains is quite high if you believe it will gain adoption in the future.

When you are in the small chain that is flexible it migrates assets from one blockchain to another if stuff actually does hit the fan.

Let me give you an example: this is the Poppin Puffins collection from Terra Luna but terra luna is collapsing so it moves to Algorand.

Even though it is not the same NFT, it doesn’t really matter if the community migrates as well.

A “blue-chip” NFT collection on a chain like Algorand can be much cheaper to acquire compared to a similar collection on Ethereum. Let me give you another example:

KNITheads frogfam

Back November 2021 sell for 43 Legoland equivalent $80 when the algorand price is $1.85

On April 2022 sell for 3500 algorand equivalent $2450 when the algorand price $.70 cents.

3. Check out upcoming generations of established NFT projects (they are super cheap)

These usually have a lower entry price as they are looking to open up a collection to new holders.

For example, M.N.G.O is the second generation to the Yieldlings project on Algorand. This project can be considered a “blue-chip” on Algorand due to constant innovation and strong sales throughout the bear market.

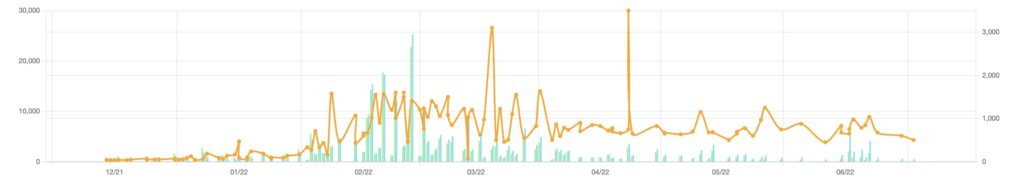

As you can see here M.N.G.O is above average sell volume for yieldlings project. So you never know gen2 will outperformance gen1.

4. If you are a NFT trader, keep liquidity and take profits when you can

In a bear market, you will see great deals quite often because everywhere is on sale.

To take advantage this opportunity is to keep a portion of your NFT capital liquid and available. Try to stick to this because it isn’t always simple to easy sell an NFT quickly for a good price.

Trading NFTs actively sucks up a lot of time and the best traders are almost doing this full-time. It’s probably a better idea for most of us to hold projects that we believe in, but take profits from time to time. DCA dollar cost average.

5. Always caution the hype and influencers from social media

A lot of the hype behind collections can be summed up:

- People are genuinely excited about the NFTs they own and are showing it off

- Marketing by the team

- Influencers have been paid or incentivized in some form to showcase a collection

- Market manipulation

Let’s look at the third and fourth points a little. Influencers have become modern advertising communication platforms.

So let me show you a few examples:

Time wonderland is built good hype by a bunch of YouTubers and they show how much they make in a short period of time. And slowly the project got the rug pulled.

Another promising project is terra luna is building on good hype by a bunch of YouTubers and they show how easy you can 100x your money in a short period of time again. And slowly the project collapsed.

Market manipulation has always happened in all markets. It’s just easier at a smaller scale and the NFT market is no exception. I have seen whales generate incredible volume on day 1 of an NFT drop only for them to look for exit liquidity quick money, or do other things for the effect of hyping a collection to get your money and that when they exit.

So always ask yourself :

“How did I find out about this and wh what is driving this hype”.

And when in doubt always follow point no. 1. People are genuinely excited about the NFTs project not from influencers or market manipulation.

6. Don’t Fomo (Fear Of Missing Out)

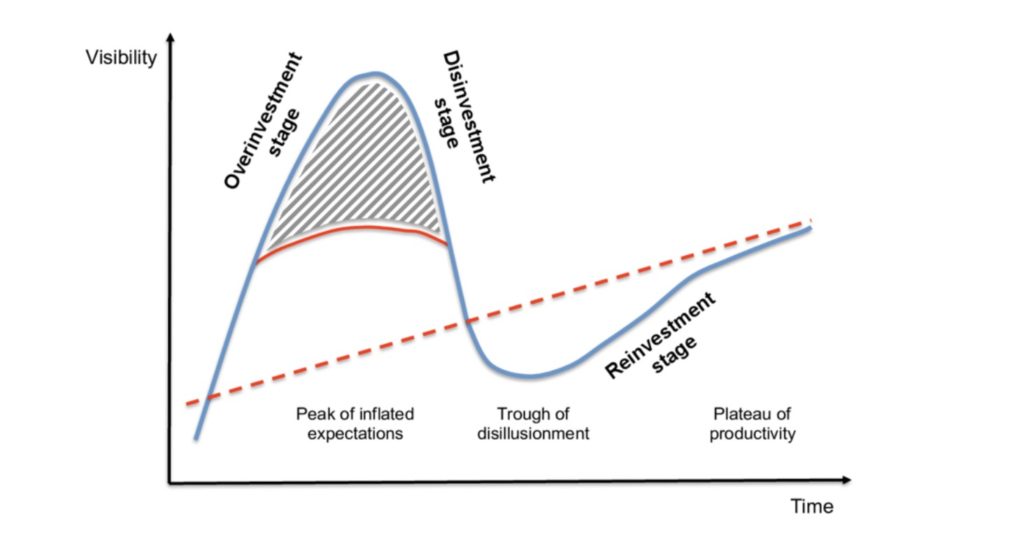

The probability of you finding out about a collection it is mean it already entering its “peak hype” phase is pretty high.

Ask anyone who has traded NFTs for a while if this has ever happened to them:

- They find out about a collection from a discord buddy, Twitter or some other source.

- They see the floor price basically doubling every few days and volume skyrocketing.

As you can see from this graph

When everybody is hype, the project is already in the overinvestment phase, me & you are probably on top of the peak

then it is the slowly disinvestment phase when other people see a great opportunity to make a quick profit. Sell Sell Sell

And the next reinvestment phase is for long-term investor who believes in the project.

Now if you see the graph like that consider call healthy. The problem; many collections just don’t make it past the “disinvestment” phase,

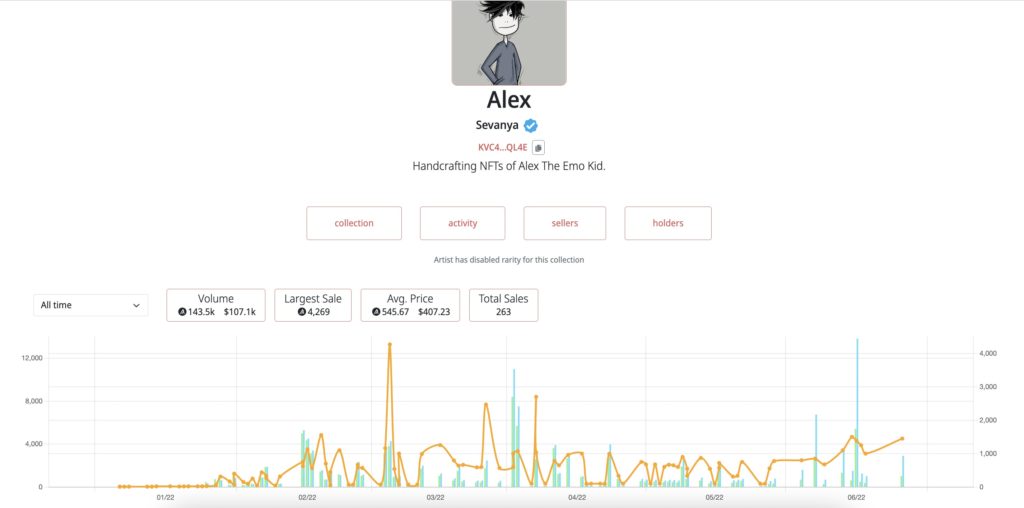

while every single established NFT collection has had its initial hype phase and is in the reinvestment phase. Here’s an example of the established NFT Alex

7. Understand that you’re dealing with highly-speculative “centralized” assets

Investing in crypto is one thing. Buying NFTs is 10 times riskier. NFT projects live and die by their creators and teams. While a collection is not completely minted, an artist may get bored, rug the project entirely, have no long-term plan or devalue their own creations.

The community managers, mods, and developers can tank their own projects in a many of ways.

So keep in mind the risks and the dependency on a small group of people that can bring success and failure to a project and your portfolio.

Make sure the developer has great communication with the community. They follow their road map and deliver what they promise. And apologize for their mistake to the community if they make one.

I’m currently invest in defi kingdoms, I do a lot of content about this project. Because I like project and I keep this project in my portfolio for long term. The reason why i love this project so much because they alway deliver what they promise on their roadmap, the community is strong and the team is authentic.

Source:

Medium Article By Anchorschmidt