Ally bank review 2021 for online savings account, checking account, investing, buckets, high yield CD.

Are you tired of paying bank fees? You are not alone, me too. Thanks to online banking, opening a checking or savings account has never been easier.

However, it’s often difficult to pick the best online bank. There are so many variables to consider — interest rates, fees, account minimums, even how you can deposit or withdraw money.

It’s a lot to take in but don’t worry I’m here to help. You can easily do all of your banking, borrowing, and investing through Ally Bank. But is it the right choice for you?

In today’s article, we going to talk about ally bank review by the end of this video, you will know how does it work? How much do they pay you? And important of all is it really worth your investment or not we about to find out so sit back relax and drink some coffee.

What Is Ally Bank?

Ally Bank was originally founded by General Motors back in 1919 as General Motors Acceptance Corporation. It got its start offering car loans to customers, and it continues to offer those loans to customers today. In 2010, GMAC re-branded as Ally and became a fully online bank, offering banking products, home and auto loans, credit cards, and wealth management and brokerage platform.

What Services Does Ally Bank Offer?

- Online Saving Account

- Money Market Account

- Interest Checking Account

- Certificate Of Deposit

- And More

Online Saving Account

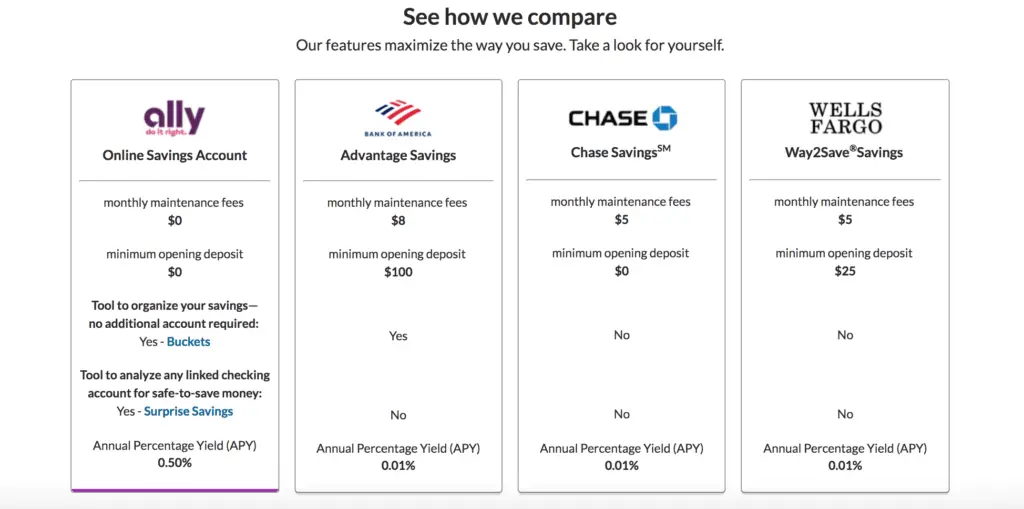

Ally’s Online Savings Account pays a relatively high annual percentage yield (APY) on deposits.

You can earn 0.50 % APY, regardless of your account balance. There’s no minimum initial deposit or ongoing minimum balance required.

To fund your account, you need to transfer money from another account, mailing checks for deposit, wiring funds, or making a mobile check deposit.

The beauty is there’re no monthly fees. Check this comparing out:

According to its website, you can only withdraw or transfer money up to six times per month from your savings account.

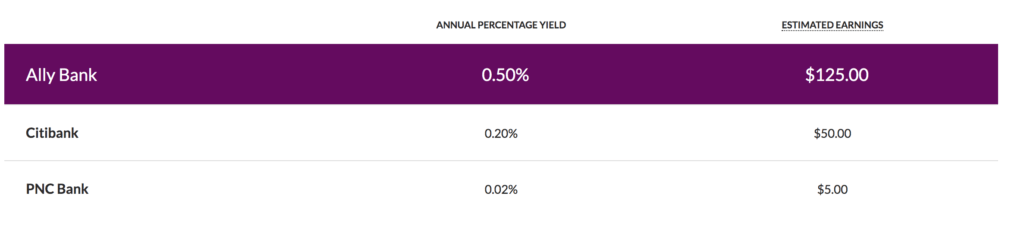

Money Market Account

Money Market Account in short is MMA. This account is a hybrid of checking and savings accounts: You earn interest, but you can spend your money instantly.

What is the interest? It is at 0.50% APY, it’s a higher rate than many of its competitors.

You will get a debit card and free checks for spending your money. And the wonderful thing is no monthly maintenance fees. You also get to same ATM access as a checking account. And your hard earn money is FDIC insured.

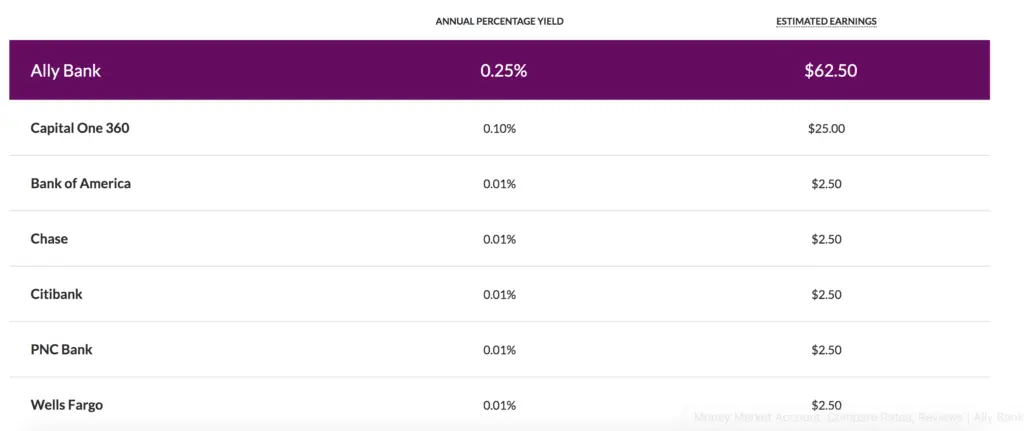

Interest Checking Account

It is obviously free and pays a modest return on your cash. You will earn 0.10% on balances of less than $15,000. And earn 0.25% on balances of $15,000 or more. There are no monthly maintenance fees.

You can check another bank right here nothing can beat it. This is an excellent option for everyday spending.

You earn interest on your account balance, you can easily pay bills online, and you get a debit card for cash withdrawals and everyday spending.

You can withdraw cash at any Allpoint ATM for free. Ally does charge you a 1% foreign transaction fee when you get cash outside of the U.S. You can use the Ally website to find Allpoint ATMs near you.

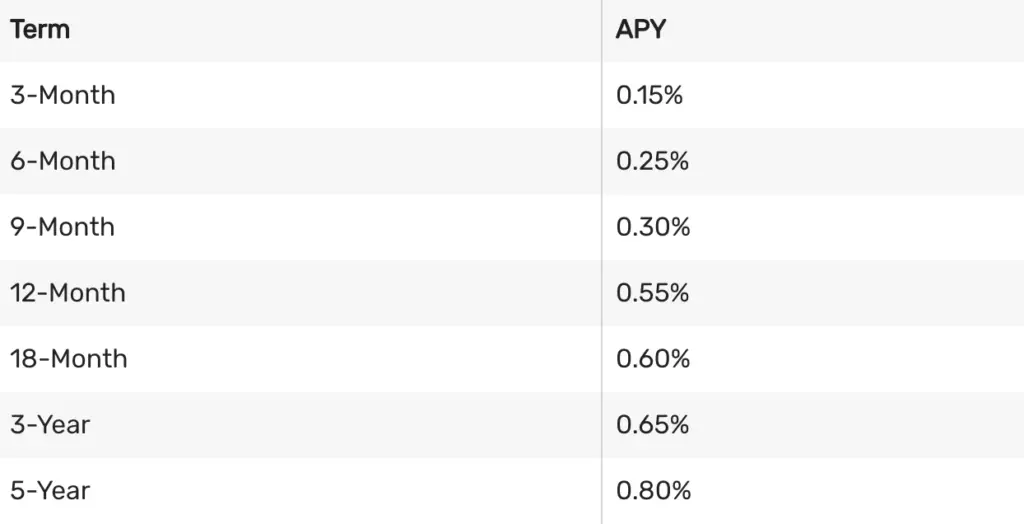

Certificate Of Deposit

They are traditional CDs that require you to commit to leaving funds with the bank for a specific length of time.

Ally offers three types of CDs:

- High Yield CD: a standard certificate of deposit with terms from 3 to 60 months.

- Raise Your Rate CD: Two- and four-year terms. You’ll also have the opportunity to increase your rate over the course of your term period if your balance tier goes up.

- No Penalty CD: Eleven-month term. You can make a withdrawal at any time, penalty-free, and keep your accumulated interest.

You can check out the rate right here.

All of Ally Bank’s CDs come with a loyalty reward of 0.05% when you renew a CD into another Ally Bank CD at the end of your term. They are FDIC-insured, come with no maintenance fees, and you can access them from the app.

You can fund your CDs by transferring money from a linked account, check, or wire transfer. There is no minimum to open a CD, but you must fund the account within 60 days or it will be closed.

All CD accounts have a maturity grace period of ten days. During this period, you can either withdraw funds, including interest, without penalty, add funds to the account, or let it automatically renew.

You going be like mike which account I should choose. It is depending on your goals for your money. For instance, if you want a higher interest rate with the functionality of a checking account, the MMA is probably best.

However, unlike the checking account, you are subject to the six-withdrawal limit and you can’t use the bill pay feature.

If you plan to withdraw a lot of cash or want an easy way to pay bills online, you might prefer the checking account.

If you’re looking to use this as a way to save money for a long- or short-term goal, the savings account is likely your best option.

Who Is Ally Bank Best For?

This should appeal to most consumers looking for a solid online bank account. It may be a particularly good fit for customers who want to:

- Earn a competitive return on savings

- Open a savings account with no minimum balance requirement

- Open a checking account that comes with a debit card and no monthly maintenance fees

- Earn more on their cash with CDs that require no minimum deposit

- Bank with an established, well-known online bank.

How To Open An Ally Bank Account?

In order to get started and open any of your Ally Bank accounts, simply visit Ally.com, select any of your preferred account types. You can find accounts in the header section of the website and click the button to open your account.

Alternatively, you can call Ally Bank at 1-877-247-2559 to request opening an account.

Be aware that just like with any financial institution, you’ll be required to provide your personal and legal information when opening a bank account.

Once you have opened your Ally Bank account, you can download the Ally Bank app on your iPhone and Android and log in.

Ally bank don’t just offer banking they also offer other service like:

- Credit cards

- Auto lending

- Home lending

- Home refinancing

- No-Fee Individual Retirement Accounts (IRAs)

- Professionally managed investment portfolios

- Self-directed investing

- Foreign exchange trading.

Now let’s talk about Pros Vs Cons

Pros:

- No monthly maintenance fees or minimum balances on checking, savings and CD accounts

- An above-average annual percentage yield (APY) of 0.50% on savings.

- Access to over 43,000 free ATMs

- 24/7 customer support

- A well-designed and self-explanatory platform

Cons:

- No way to deposit cash

- No physical location

Now you might be wondering is it a legit company? Or scam?

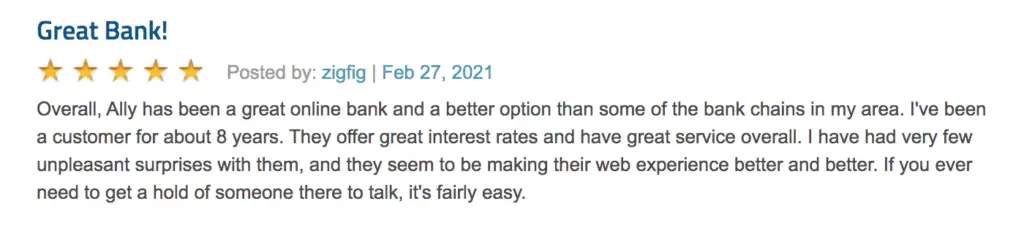

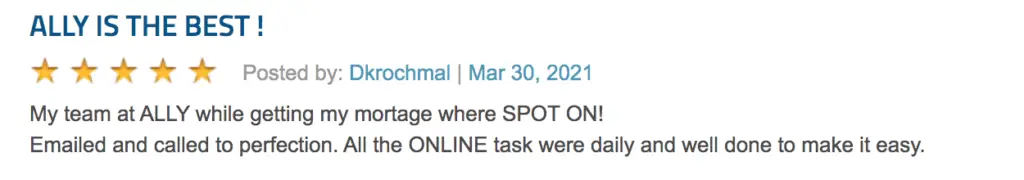

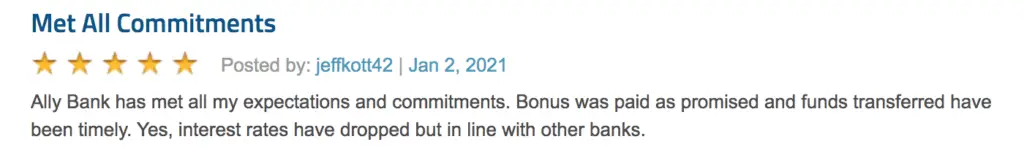

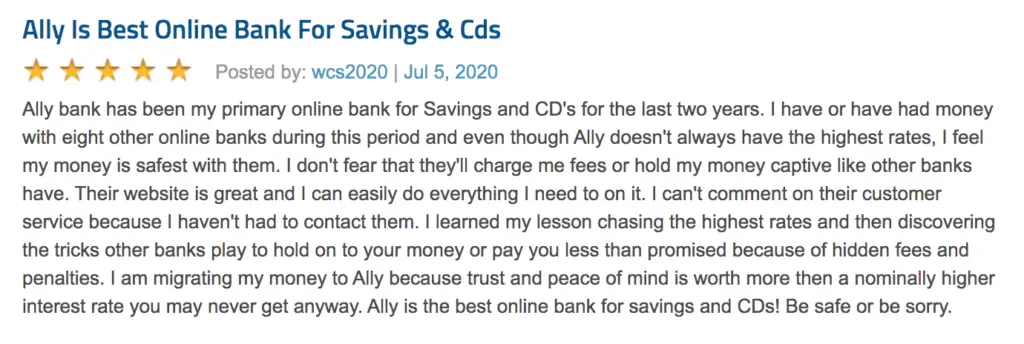

I already do-little research for you. Let see what it said