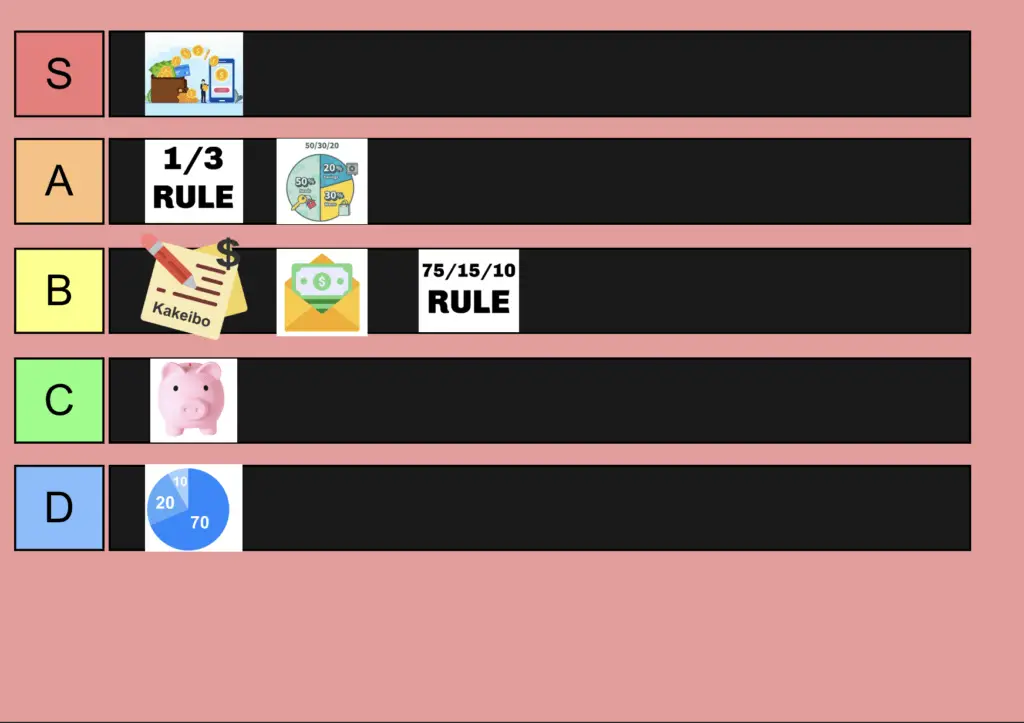

Welcome to the Ultimate Saving Money Tier List In 2023! From coupon clippers to frugal geniuses, I’ll show you which money-saving strategies are worth their weight in gold and which ones belong in the bargain bin! Put your wallet away and join me as I rank some of the best and worst methods for saving money.

Piggy Bank

We have it when we are small, keeping the money to buy our favorite.

My brother always steals it from me, so it is not super secure to keep the money.

I would be put on this C-tier list.

Automatic Transfer

I have used this method since 2010, and it still works until now. Every time I have a paycheck or income. It will automatically transfer to my saving with no hesitation just automatic.

Let me tell you something every time you have a paycheck, the government automatically deducted to tax from you. It is also included 401K, social security, and state tax.

Why don’t you use the same system as they do? Automatic transfer pay yourself first, then pay your need.

“The best way to save is when you don’t see the money in the first place” Burton Malkiel.

One book that changed my life is automatic millionaire by David Bach.

I would put this S-tier list.

1/3 Rule by this man Kevin O Leary

This book and the cold hard truth on Men, women and money

Here’s the breakdown

-

- 1/3 to go toward living expenses

-

- 1/3 to go toward home

-

- 1/3 to go towards savings and investments

“For money to save you, first, you have to save it.”

The reason behind this is that if you spend more, you are going to put tremendous stress on yourself because you have to pay the monthly mortgage payments, insurance, properties tax, and the list is endless.

This rule is hard to stick if you live in new york, California, and other high-tax cities.

I would be put on this A-tier list.

Kakeibo Japanese Budget System

Kakeibo means household finance ledger

In 1904 it was invented by Hani Motoko, Japan’s first female journalist. It is an accounting system originally designed for housewives.

but it can be adapted and used by almost anyone. It’s designed to give you control of your budget and make you aware of spending habits.

The simple system asks users to answer four questions:

-

- How much money do you have available?

-

- How much would you like to save?

-

- How much are you spending?

-

- How can you improve?

Kakeibo requires you to write down everything you buy and streamline your budget by grouping purchases into four categories:

need, wanted, culture, unexpected

-

- You can’t live without things like food, toilet paper, and shampoo.

-

- Purchases you enjoy but don’t need, like a takeout meal or a pair of new shoes.

-

- Things like books, online courses, and museum visits in the USA are free but if you live in a different country you have to pay.

-

- Expenses you weren’t anticipating, like a doctor’s visit or car repair.

So it is like a financial journal for you, what is your goal for this month for spending, if you exceed your spending now, you can go back to track which thing you need to cut back.

I do love this system however, it takes so much time just to budget and write down. So a lot intense labor work but it gives you a good habit.

I would put this B tier.

50 / 20 / 30 Rule by US Senator Elizabeth Warren

The rule is to split your after-tax income into three categories of spending: 50% on needs, 30% on wants, and 20% on savings.

50% need is what you must pay like mortgage payment, rent, health care, insurance.

30% want is you spend money on that are not absolutely essential but good for your soul. Like take your wife fancy dinner, a vacation to Europe or buy something that you love.

I work so hard for my money and buy things that I want. It actually fuels the energy inside me to be able to work more. It helps my mental health. I don’t want when I’m in my deathbed I will not regret working more, and I will regret it if I don’t enjoy my life and connect meaningful relationships with friends & family.

20% savings you need to save and invest. Your saving will protect you but investment will make you rich.

I would be put on this A-tier list.

70 / 20/ 10 budget system

it is split into three categories: 70 percent for living expenses, 20 percent to save money, and 10 percent for debt.

Here’s more detail breaking down

-

- 70 percent of your after-tax income should go toward basic monthly expenses like housing, utilities, food, transportation, and personal living expenses;

-

- 20 percent should be saved or put into investments,

-

- Leaving 10 percent for debt repayment.

Sound good that you set a side part for your debt, but this does not bring you joy. There is no enjoyment in making money if you stick to this rule. You work and be miserable yourself until you retire. If you want to pay the debt, count that into 70% of your living expenses. And leave the 10% your want.

I would put this D-tier list.

Cash Envelope System

How does it work? this is a way to track exactly how much money you have in each budget category for the month by keeping your cash tucked away in envelopes.

Let’s say you have envelopes for groceries and you put 200 per month. You can only allow to use 200 per month if it is more there is nothing left to use. And if you have extra at the end of the month. Huuuray to you.

However this system has a flaw, it is very inconvenient. Now you have to carry a bunch of chances with you everywhere you go.

On top of that since you using cash, you don’t build a credit score for yourself which it hard for you to get loan and you can’t fly for free.

Because of that, I would put this into the B tier.

75/15/10 by Minority Mindset

He said if you’re older and have a lot of financial responsibilities. You should stick to this rule:

-

- 75% of your income goes to expenses

-

- 15% goes to investing

-

- 10% goes to saving — that is, again, until you reach the 6-month worth of expenses threshold.

I love investing and I love saving but I also need vacation so if you can save up 10% within 6 months then can switch to your want. That’s what I would do.

I would put this B-tier list.

Like This Post? Do Me a Favor and Share it!